Co-parenting after a separation brings its unique set of challenges, and one of the often-overlooked aspects is managing pocket money. Whether you’re setting a fixed weekly amount or tying it to household chores, it’s crucial to maintain consistency and transparency for the sake of your children.

Why Pocket Money Management Matters in Co-parenting

For many Aussie families, pocket money serves as the first introduction to financial responsibility. In a co-parenting scenario, it’s essential to ensure that both parents are on the same page. This not only prevents confusion but also teaches children about saving money, using a debit card responsibly, and the importance of a savings account.

Top Pocket Money Apps for Co-parenting Families

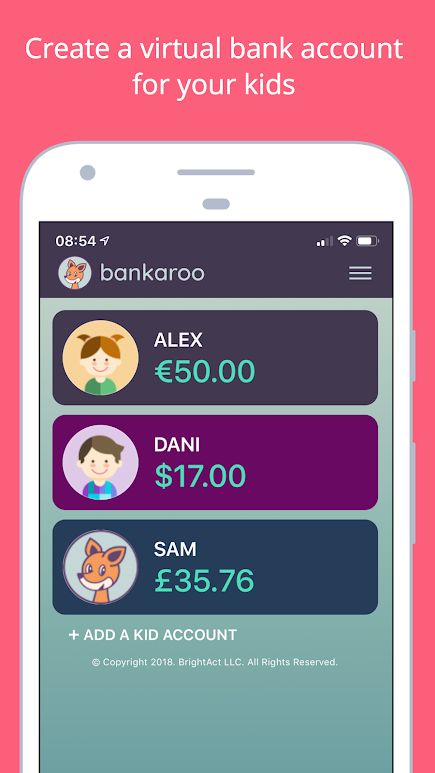

- BANKAROO: A user-friendly app that allows kids to set savings goals and introduces them to the concept of earning rewards.

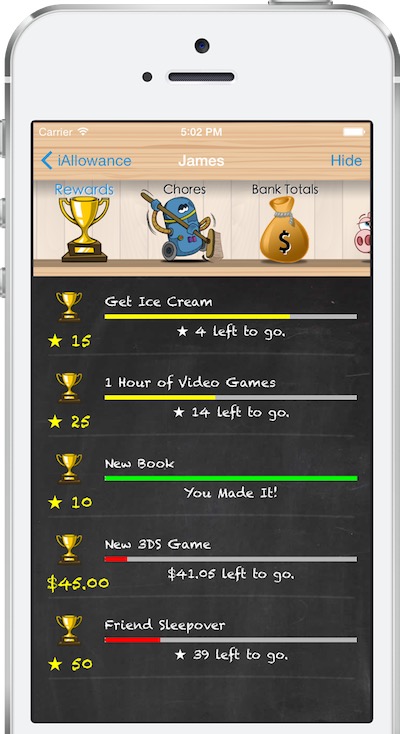

- iALLOWANCE: Exclusively for Apple users, this app combines pocket money tracking with chore management, teaching kids the value of hard work.

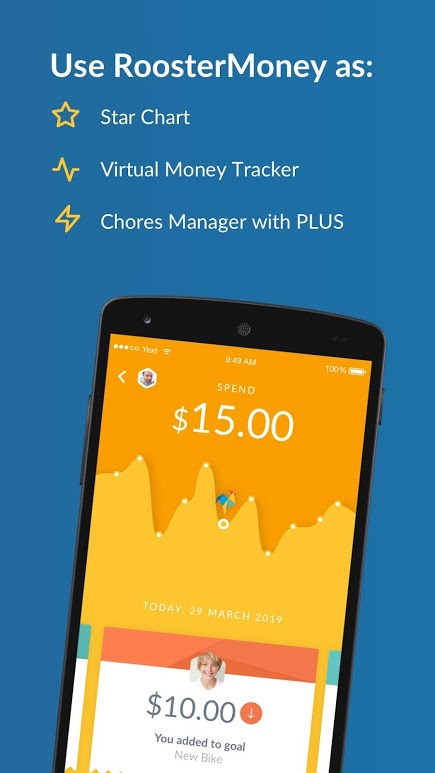

- ROOSTER MONEY: An app that offers both allowance and chore money tracking, emphasising the importance of saving and charitable giving.

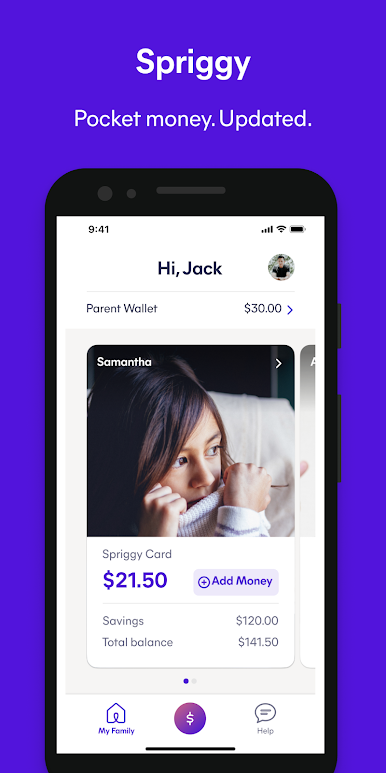

- SPRIGGY: Australia’s leading pocket money app, Spriggy is an app that introduces kids to the concept of a debit card, ensuring they spend within their means.

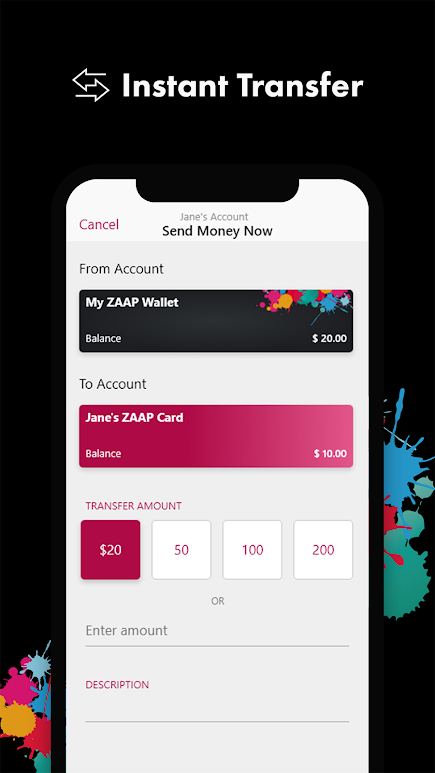

- ZAAP: Tailored for kids aged 8 to 17, Zaap offers a digital wallet experience, teaching them the basics of online and offline spending.

- OTLY!: A free app that emphasises saving and charitable donations, teaching kids the value of giving back.

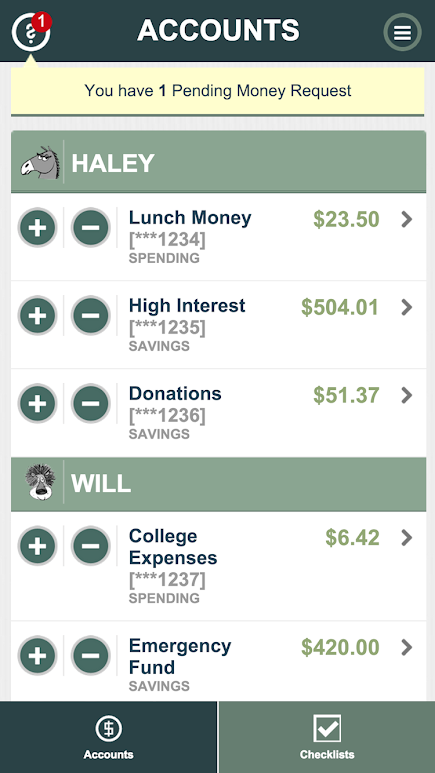

- FAMZOO: A comprehensive financial education app suitable for kids of all ages, from reward charts to budgets.

Key Takeaways for Co-parenting Families

- Consistency is Key: Ensure both parents have a unified approach to pocket money, preventing confusion and potential disagreements.

- Financial Literacy: Use it as an opportunity to teach kids about saving money, the importance of a savings account, and responsible spending.

- Open Communication: Regularly discuss pocket money management with your co-parent to ensure both are aligned in their approach.

Navigating Financial Separation? We Can Help!

Managing pocket money is just one aspect of the challenges faced by families post-separation. At Div-ide, we specialise in guiding individuals through the financial separation process. Our mission is to help you transition smoothly, ensuring you have a clear grasp of your financial standing during and after separation.

Discover More About Financial Separation in Australia

Interested in more insights on co-parenting and separation? Explore our articles on topics like the division of assets in divorce, creating a co-parenting plan, and understanding the differences between separation and divorce.