If you have separated and now have full control of your finances you must learn to manage your money in order to track spending and reach financial goals. Luckily, being financially aware is easy, and almost fun, with a wide range of brilliant personal finance apps.

These tools have a host of clever yet easy-to-use features which you can view and operate from the palm of your hand.

Whether you like working with figures, coloured charts or you prefer saving your money in good old-fashioned envelopes, there is an app for you.

Here is our pick of personal finance apps to help you get organised after divorce.

1. Mint

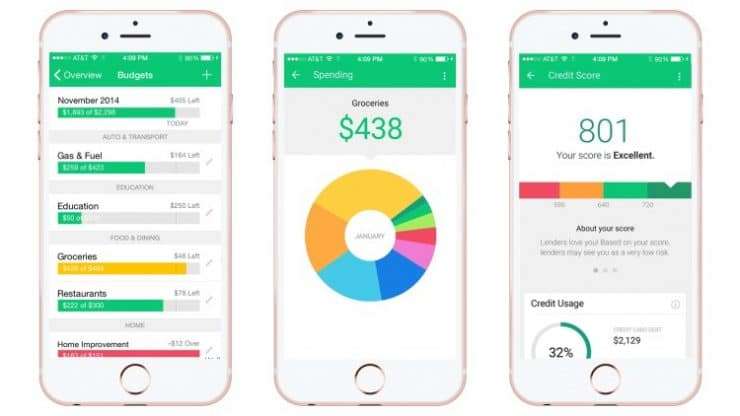

There’s a reason Mint is one of the most popular personal finance apps on the market. It’s an easy to use, all-in-one budgeting tool that syncs your accounts so you can track spending and even cash transactions. You can also set savings goals to help stay on track.

The app analyses your financial data and gives you graphs and charts that are easy to understand, even if you’ve never used a personal finance app before. It’s an eye opener when you see the categories where you are spending the most.

One of Mint’s best features is personalised financial advice based on your spending. This is really helpful if you want to save more money, spend less or just learn how to budget better. Mint is free and it costs nothing to sign up, but there are ads in the app that can be annoying if you’re used to a premium experience. Overall, it’s a solid app with useful financial advice, especially if you’re new to budgeting and personal finance.

2. Pocketbook

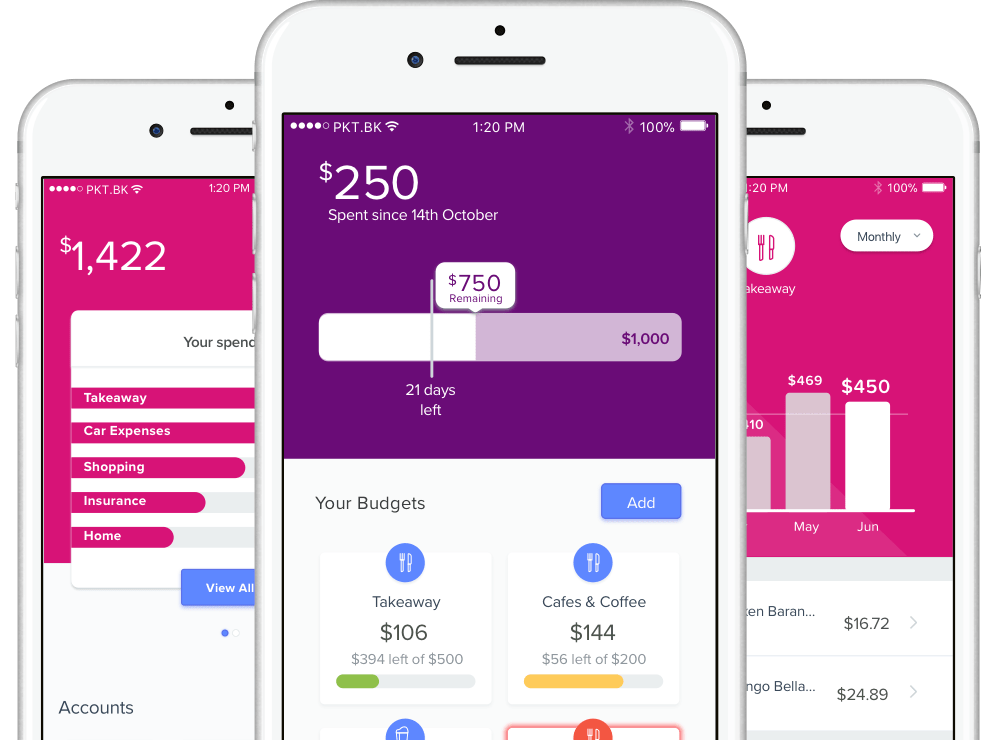

Another great, free personal finance and budgeting app is Pocketbook. Like Mint, it’s easy to use and lets you organize your personal finances by syncing bank accounts (it can sync with most of the big Australian banks). It also tracks spending habits in real time and tells you where your money goes. When you have a clear picture of your expenses, it’s easier to cut back on impulse/unnecessary purchases and start saving more money. You can even set a safe spending limit or a maximum daily or weekly spending amount.

Pocketbook is available on iPhone and Android. It’s free to sign up, but some users report that it takes a while to set up your account and the app has syncing issues. Also, you cannot add accounts that are not on the list. This can be a deal breaker if you use a smaller, lesser known bank. Despite the downsides, Pocketbook is a comprehensive financial manager that auto syncs your transactions so you can set and forget.

3. Myvelopes

Myvelopes is essentially Dave Ramsey’s envelope budgeting system in app form. If you’re a fan of that, you will love Myvelopes. The free app allows you to connect up to four different accounts, including bank accounts and credit cards, and create 25 envelopes to manage your money.

Your financial data is available at a glance and you can see where you spend the most, as well as your savings. If you have questions, you can connect with other users through an online forum and email their support team.

Myvelopes is a paid app with a free 30-day trial. The monthly subscription starts from $5.99 per month and gives you more advanced budgeting features as well as dedicated support. The app is great to track spending and curb poor money habits as far as paid budgeting apps go, but users report multiple bugs and a steep learning curve. If your main goal is saving and investing, the app doesn’t support tracking or management of investment accounts.

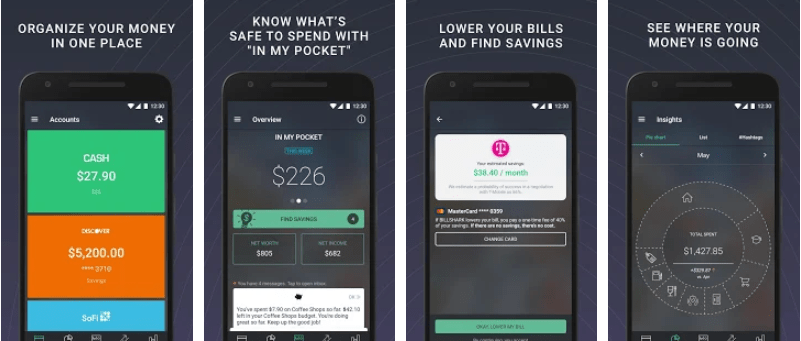

4. PocketGuard

PocketGuard is a personal finance app that tells you how much you can spend at any given moment. After syncing bank accounts and plugging in your financial data, including bills and savings goals, it gives you a picture of how much money is left in your pocket for today, this week and the entire month. There’s peace of mind in knowing exactly whether or not you can afford certain purchases.

PocketGuard is available on iPhone, Android and desktop. There’s a free ad-supported version, and a paid version that costs $3.99 per month or $34.99 annually. The premium version is an excellent budgeting tool with added features and customer support, but the free app is good enough for household budgeting if you don’t mind ads and email offers.

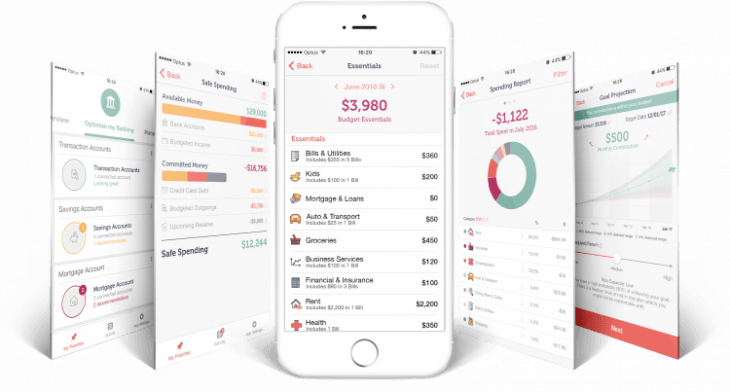

5. MoneyBrilliant

MoneyBrilliant brings multiple financial accounts into one dashboard so you can easily see where your money is going and how you stand financially. The app tracks bills and expenses and allows you to set savings goals. You can connect to over 200 financial institutions including bank accounts, credit cards, loans, mortgages, superannuation and even loyalty cards. One of its strongest features is the spending breakdown that gives you a complete picture of your finances.

The free version has basic tools for personal and household budgeting, but if you want more advanced features like identifying tax-deductible transactions and getting better deals on utilities, there’s a subscription option that costs $9.90 per month or $99 a year. Paying for an app can be counter-intuitive when you’re trying to save, so we suggest trying the basic app first. Available on the App Store and on Google Play.

6. TrackMySpend

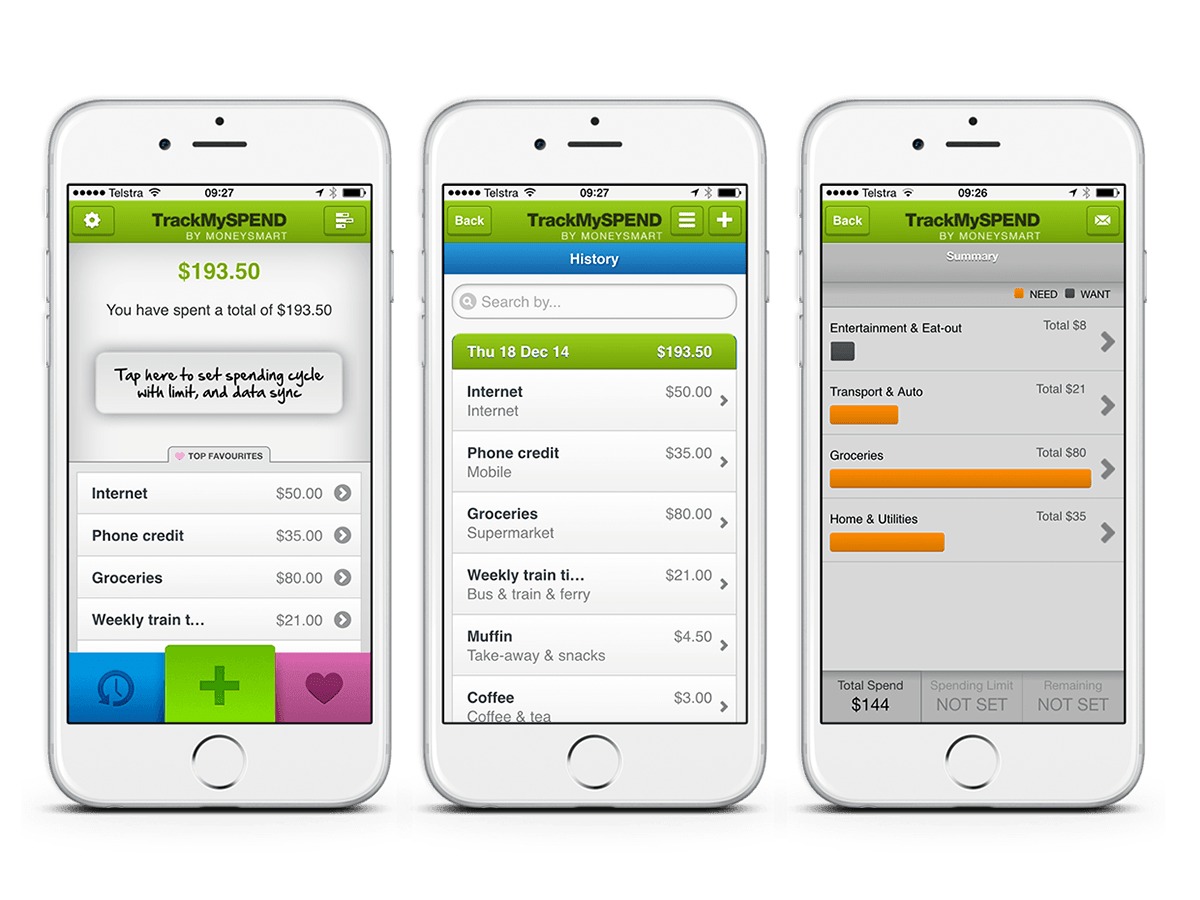

Australians can track their finances easily with Track My Spend, developed by the Australian Securities and Investments Commission (ASIC). The app is simple and easy to use and perfect for people who are new to budgeting or those who want to get their budget back on track. There’s practically no learning curve involved, you just set up your account and go. One of its best features is the ‘favourites’ tab that saves frequent transactions to save time.

TrackMySpend is perfect for those who use cash more than credit cards. It lets you set your spending cycle and limit, and manually add in expenses. Because it’s a basic budgeting tool, you can’t record income or savings goals. You must enter everything manually, including bank account details. This can get tedious if you have lots of transactions. But it’s completely free to use and handy if you want a no-fuss way of managing your finances. Get the it on the App Store and Google Play.

7. Spendee

Spendee is a personal finance and budgeting app that syncs bank details automatically and organises transactions into categories. Users can add cash and other expenses manually so you can quickly monitor spending. The more you use the app, the better it gets at tracking your spending habits. It crunches the numbers and creates charts to show you a better picture of your income and expenses.

The free version (Spendee Basic) does not have backup and sync feature or automatic categorisation. It also limits cash wallets and budgets to one. Get the paid version if you need a more advanced tools to boost financial fitness, including shared budgeting and unlimited cash wallet. You can try all features free for 7 days before you commit. Available on the App Store and Google Play for $14.99/year (Spendee Plus) and $22.99/year (Spendee Premium).